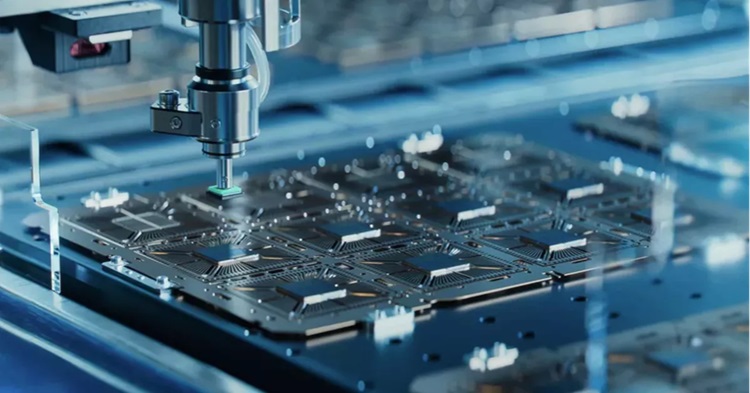

Bangladesh not ready yet to tap booming $1 trillion semiconductor industry

With zero investment and no planning, Bangladesh is far from being ready to enter the globally thriving semiconductor industry, which is projected to generate $1 trillion in revenue in 2033.

Successive governments, including the incumbent one, aimed at building the industry by applying only rhetoric, failing to attract any investment to the industry that has been on an expansion spree in Asia for some time now.

The revenue of $8 million that Bangladesh generated in the last financial year was the fruit of the hard work of freelancers and private information technology firms.

Government incentives proved crucial to the industry’s growth in Asian countries, where nations offered tax waivers, land to the investors and even subsidies.

“Taiwan, China, India, Vietnam—all top-performing countries in the semiconductor sector—received substantial government support. If Bangladesh wants to succeed, the government must provide continuous subsidies and duty-free incentives for several years,” said Professor A.S.M.A. Haseeb of BUET’s Department of Nanomaterials and Ceramic Engineering.

Semiconductors are considered the building blocks of modern electronic technology. They work at the same time as a conductor and an insulator in an electronic device, ensuring its smooth functioning. A semiconductor can be microscopic, existing in millions in just a small part of the device.

Christopher Miller, an economic historian and a teacher of International History at Tufts University in the USA, in his 2022 book Chip War predicted that semiconductors will become more valuable than oil in the future.

In the modern world, he wrote in the book, a person with a smartphone, laptop, and smartwatch uses 60–110 billion semiconductors daily.

Silicon Valley, the Mecca of technology and innovation, owes its success to the semiconductor industry. Initially using in-house semiconductors, Silicon Valley later shifted packaging, design, and various transistor chip manufacturing to Asia, mainly to cut costs, taking advantage of cheap labor, Miller noted in his book.

Apple, for instance, sources its components, such as memory chips from Japan, frequency radio chips from California, audio chips from Texas, while manufacturing processors in Taiwan and assembling smartphones in China and India.

The invention of the transistor marked the dawn of the semiconductor industry in 1947. The world has since only witnessed an increase in the demand for semiconductors, with electronic devices flooding modern lives.

Asia Hosts World’s Largest Semiconductor Market

The world’s largest semiconductor manufacturing company is in Taiwan, which started making semiconductors in the 1990s. The company’s total investment in the United States is expected to reach US$165 billion this year. Taiwan’s current annual production of semiconductors is one quintillion. The Taiwanese government announced a subsidy program of $9.3 billion up to 2033.

Introduced in 2010, the semiconductor industry fetched $15 billion for Vietnam. Vietnam is involved in the packaging, testing and designing of semiconductors. In 2024, Vietnam attracted approximately 174 FDI projects worth US$11.6 billion. Last March, the Vietnamese government invested US$500 million in the industry.

India started producing semiconductors in the 1970s. With an estimated revenue generation of a maximum $50 billion in 2025, India expects to make $100 billion in 2030. The latest target is about three times what India earned in 2023. In August, India announced a $7 billion incentive to the semiconductor industry.

In 2024, Malaysia exported semiconductors worth $130 billion in 2024. Malaysia’s semiconductor industry dates back to the 1970s.

China, on the other hand, exported $142 billion worth of semiconductors in 2024 following an investment of $48 billion.

Where Bangladesh Stands

Bangladesh lacks even a plan to enter the industry.

Bangladesh’s 200,000 engineers entering the job market annually with electrical and electronic engineering and computer science engineering degrees struggle to find jobs.

“Although Bangladesh is not yet prepared for semiconductor manufacturing, it can enter the packaging market. Due to low costs, many countries will be interested in investing here,” said Haseeb.

In 2023, BIDA projected the semiconductor export market to be $3 billion in five years. The past government promised a comprehensive plan and a roadmap that never materialised.

The incumbent government that replaced the past AL government had some strategies formed for developing the semiconductor industry with goals set for the short, medium and long terms.

“Current foreign investments in Bangladesh are mostly in traditional sectors. We need more investment in semiconductors than in garments. This will reduce dependency on single-product exports and develop skilled human resources. A separate investment model is essential,” said Fazlee Shamim Ehsan, president of the Bangladesh Employers Federation.

BIDA’s head of business development, Nahian Rahman Rochi, said that they were preparing a proper plan.

“This is a new sector for Bangladesh. Attracting investment requires a concrete plan and proposal. Efforts are underway to remove investment hurdles. BIDA sees strong investment potential in this sector,” Rochi added.